What employers need to do

Employers play an important role in Paid Leave Oregon, and the Paid Leave team is here to help.

Create your account in Frances Online

Frances Online is Oregon’s payroll reporting system. Frances Online is where you, as an employer, will file your payroll report. This is also where you will report Paid Leave Oregon contributions. You can easily create an account today!

You’ll need to have a few things ready when you create an account:

- Business Identification Number (BIN)

- Federal Employer Identification Number (FEIN)

- Nonprofit Employer Identification Number (EIN)

- Payroll information from reports you’ve filed within the last 2 years (you can find a list of these under frequently asked questions)

- If you don't have payroll report data, you can request a verification letter from the Oregon Employment Department

Small employers with fewer than 25 employees on average don’t have to pay the employer contribution. You still must collect contributions from employee wages and send them on their behalf. You must also protect their jobs and positions. This means they can’t lose their job or position if it still exists when they return from paid leave.

Your employees are covered by Paid Leave and can apply for Paid Leave benefits.

Learn more about what small employers need to know about Paid Leave.Learn about your responsibilities with Paid Leave Oregon

- Report employer contributions. You must pay the employer portion of the contribution if you have 25 or more employees on average.

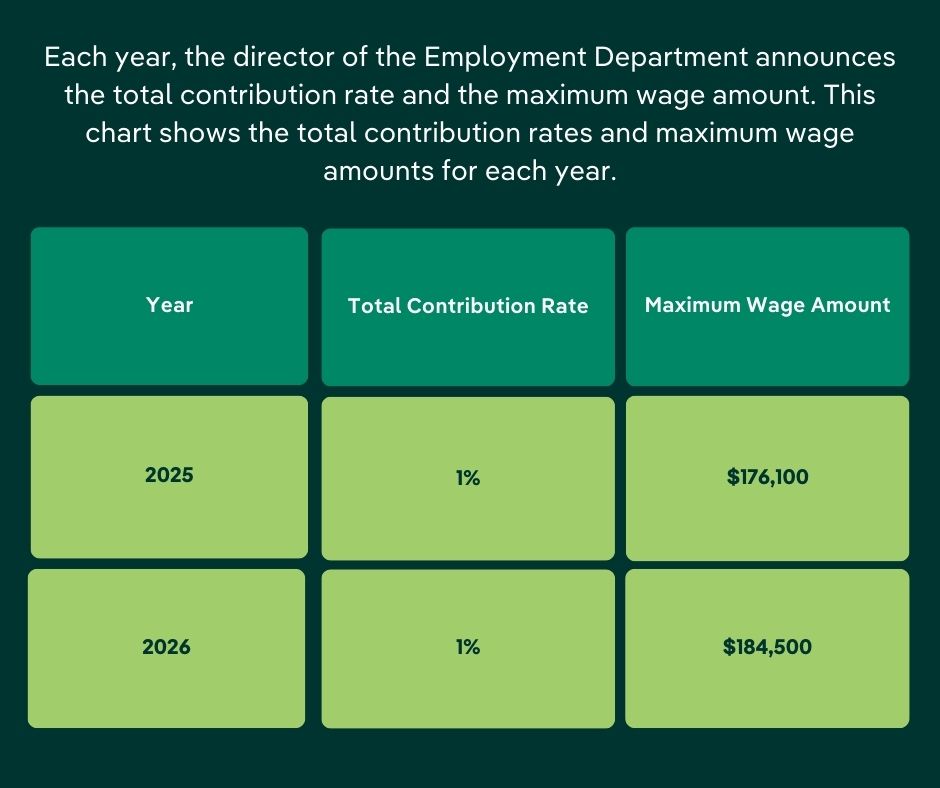

- Large employers with 25 or more employees must pay 40% of the total contribution rate (which is 1% for 2026), up to the social security wage index of $184,500 per employee, per year.

- Use this contributions calculator to estimate how much you’ll contribute.

- Withhold your employees’ contributions. You must withhold contributions from your employees’ wages. Employees pay 60% of the total contribution rate (which is 1% for 2026) up to the social security wage index ($184,500) for the year.

- Pay contributions each quarter. You must list employee and employer contributions (if applicable) on your Oregon Combined Payroll Tax Report, whether you are a small employer (fewer than 25 employees) or large employer (25 or more employees). If you use a third-party payroll administrator, or payroll company, they can take care of withholding your employee's contributions. Make sure they know how to file a report.

- You can estimate how much you will pay based on the number of employees you have and the amount you pay in wages. For example, if you have $1 million in payroll, you pay $4,000 (which is 40% of the 1% contribution rate) per year and your employees pay $6,000 (60% of the 1% contribution rate) per year. This is a total contribution of $10,000 for the year.

- File your payroll reports in Frances Online each quarter.

- Report the total number of employees you have, the total Paid Leave subject wages you paid for the quarter, and the contribution amount.

- How to change a report:

- In the Wages and Contributions panel in Frances Online, select View or File Payroll Reports

- Select the Periods tab and then select the period where you want to make changes

- Pay the total contribution payment (both the employer portion (if applicable) and employee portion) each quarter by making a payment through Revenue Online (also linked in Frances Online).

-

How to make a late payment

Late payments can only be made in Frances Online. Here's how:

- In the Wages and Contributions panel, select Pay Outstanding Balance

- Pay electronically and select Next

- Enter your payment information and select Submit

-

We have video instructions on how to file in Frances Online.

- Give eligible employees time off. You must give your employees time off if Paid Leave approves their leave.

- Hold your employee’s job and role. Your employee has the right to the same job they had when they left if your employee has worked for you for more than 90 consecutive days. If their job no longer exists when they return from paid leave, and you have more than 25 employees on average, you must give them a similar position when they return from leave. If a similar position isn’t available in that location, you must offer a similar position in another location within 50 miles. If you have less than 25 employees on average, you can give them a different position with similar job duties and the same benefits and pay when they return.

- Post the model notice poster in a visible place. Employers must post the model notice poster at each work site and provide a copy to any remote employees. Download a printable poster. If you have an equivalent plan, you also need to post a model notice poster. Learn more by reading the Equivalent Plan Guidebook.

Still have questions? Read the Employer Guidebook.

Maximum wage rates

A third-party payroll administrator is a person or company that helps an employer process payroll. To make payments or file a report, here’s what a third party payroll administrator needs to do and know:

- Start by creating an account in Frances Online

- You will need your client’s account information or previous payroll reports to show that you are authorized to access their employer account

- You don’t need a power of attorney to file on the employer’s behalf

- To find their account in Frances Online, you can search using their Business Identification Number (BIN)

Third-party payroll administrators - file reports in Frances Online.

As a third-part administrator (TPA) you may need to answer Frances Online questionnaires for your client that we send as part of the employee’s application for Paid Leave benefits.

In this video, you’ll learn how to:

- Add a new client

- How to add benefits account access to new and existing clients

What is benefits access?

It’s the type of access in Frances Online that allows you to answer the questionnaires we send about employees.