How the benefit application process works

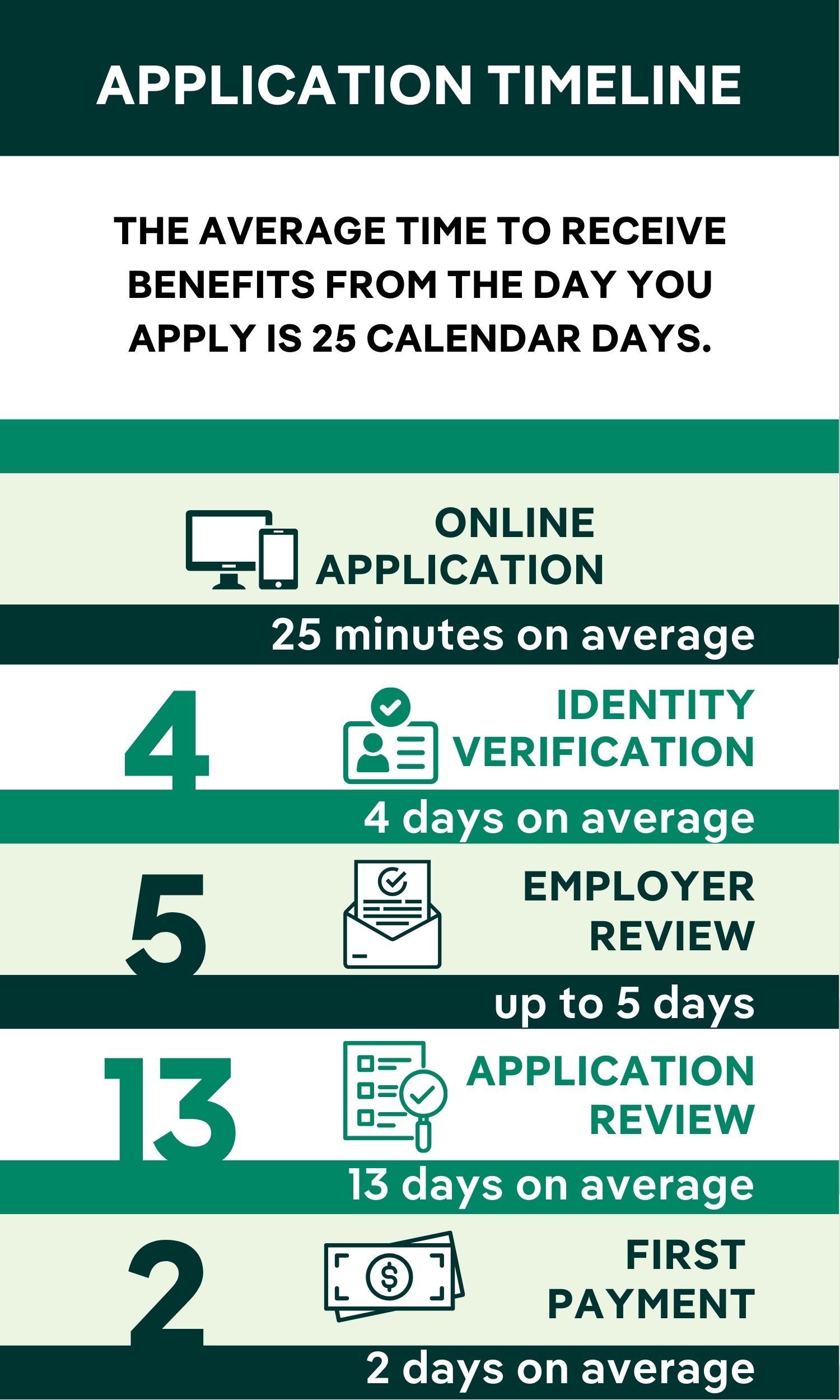

If you apply today, here is the number of days you can expect it to take to get benefits, if you’re eligible. While this is the average number of days, your claim may take more or less time, depending on how complex your claim may be.

Benefit application process

The fastest way to apply for paid leave benefits is using our online computer system, Frances Online.

Paper applications

Frances Online is the quickest and easiest way to apply for Paid Leave. You can answer questions from Paid Leave staff and check the status of your application or payments. If you can’t access Frances Online and send us a paper application, it may take longer for you to receive a response.

Once you enter your information, the system will automatically estimate your benefit amount and your benefits start date. You will see this amount and date on your Frances Online home page. The system does this before we begin reviewing your application. It doesn’t mean that we have approved your application. It is just an estimate.To protect your benefits from people who may have stolen your information, we need to verify your identity. Your claim can’t move forward until we’ve verified your identity. If you send us incorrect information, that could delay your benefits.

Sometimes, we may need more information to verify your identity. We may send you a letter in the U.S. mail, even if you chose to get email alerts when you set up your account. Please watch your U.S. mail and be ready to answer any follow-up questions we may have.

We contact your employer to confirm that you are their employee and make sure you gave them notice that you applied for paid leave. We give employers 5 days to respond. If they don’t, we move your claim forward without their input.

We check your application to make sure you are eligible for benefits. There are many rules that apply to Paid Leave Oregon, and we must make sure you qualify.

We review different parts of your application separately. You might get more than a few requests for information along with more than one decision letter from Paid Leave. It is important to read all letters to make sure your information is correct.

Here are some types of communications you might receive in your Frances Online account:

- First, we make sure that you made at least $1,000 in subject wages or subject self-employed taxable income during your base year or alternate base year. If you are self-employed, we make sure that you have also paid contributions during this time frame. We may send you messages in Frances about a “monetary determination.” These are letters that include details about your income during your base year or alternate base year. We send you this decision before we approve your application and send you a benefits decision letter. A monetary determination notice may include a letter that asks you for more information. If you meet this eligibility requirement, the letter will also include your potential benefit amount. Again, receiving this letter doesn’t mean that we have approved your application.

- Next, after we make sure you meet the income eligibility requirement, we look at other requirements related to your type of leave (family, medical, or safe) or other information. We often send you questionnaires and letters asking for additional information about your leave event or other related information. We send these questionnaires to you after we have made sure you meet the income requirement, but before we approve or deny your application. With these letters, we are making sure that your life event for your type of leave (family, medical, or safe leave) is eligible for paid leave. Also, we often need you to fill out a form that your health care professional needs to sign. After you have completed the questionnaires and provided the forms, you may receive messages in Frances Online that are related to these called “non-monetary determinations.”

Once we decide you are eligible for benefits, we will approve your benefits and tell the state’s bank to send your first payment. If you chose a debit card, this is when we have the bank mail your debit card.

The amount of time it takes for you to receive this payment depends on if you chose direct deposit or a debit card. Your direct deposit is dependent on how long it takes your bank to release the money. If you chose a debit card, it takes about 10-14 business days for you to get it in the U.S. mail.

If there is a mistake in your banking information or if we can’t release your benefits to your bank for some reason, we will send you a debit card instead of using direct deposit.

Note: If you are claiming intermittent leave, which means you work some of the days during your leave, you won’t receive your benefit payment until you claim your first week. You must wait until the end of the week to file for benefits.As we receive more information about your claim after we approve it, you may receive letters that tell you about a change in a previous decision we have made about your claim.

Continue to check your Frances Online account and your U.S. mailbox for letters so you can quickly answer any other questions we may have about your application. This will help your claim move forward as quickly as possible.

Base year and alternate base year explained

We use calendar quarters to find your base year or alternate base year. A calendar quarter is a three-month time frame, and is usually defined on a yearly basis:

- January-March as the first quarter

- April-June as the second quarter

- July-September as the third quarter

- October-December as the fourth quarter

Note: You can’t choose if we use your base year or your alternate base year.

Base year

Your base year is the first four of the last five completed calendar quarters before the start date of your paid leave benefit year. The start date of your benefit year is the Sunday before your first day of leave. We always use your base year to decide if you are eligible for benefits unless you made less than $1,000 in subject wages or subject self-employed taxable income.

Example:

Your paid leave benefit year starts on Feb. 2, 2025. We need to find the five completed quarters before your benefit year start date to calculate your base year. Because Feb. 2, 2025, is in the first quarter of 2025, we don’t include that quarter in your base year because it isn’t complete.

The five quarters before the first quarter of 2025 are:

- The four quarters of 2024 and

- The last quarter of 2023

That means that the first four of those five quarters are your base year and include:

- The last quarter of 2023 (October-December) and

- The first three quarters of 2024 (January-September).

You may be eligible for benefits if you made at least $1,000 in subject wages or subject self-employed taxable income between October 2023 and September 2024.

Alternate base year

Your alternate base year is the four most recent, completed calendar quarters before the start date of your paid leave benefit year. Again, the start date of your benefit year is the Sunday before your first day of leave. If you made less than $1,000 in your base year, then we check your alternate base year to determine if you are eligible for benefits.

Example:

Your paid leave benefit year starts on Feb. 2, 2025. We need to find the four most recent, completed quarters before this date. Because Feb. 2, 2025, is in the first quarter of 2025, we don’t include that quarter in your alternate base year because it isn’t complete.

The four most recent, completed quarters are the four quarters of 2024. Your alternate base year in this example is January-December 2024.

You may be eligible if you made at least $1,000 in subject wages or self-employed income between January-December 2024.